Virgin Voyages Travel Insurance - 2024 Review

Virgin Voyages Travel Insurance - Review

7

Strengths

- Strong Insurance Partner

- Easy To Buy At Check Out

Weaknesses

- Poor Medical And Evacuation Cover

- Few Cancellation / Interruption Reasons

- Expensive

Sharing is caring!

Background

Virgin Voyages offers cruises to adults aged 18 and up (no children allowed) that feature high tech amenities, low environmental impact, and complimentary drinks and dining. Although Virgin Voyages offers a variety of cruises, cabin types, and dining options, they only offer a single option for travel insurance, which is their Voyage Protection plan.

Arch Insurance Company, a strong insurance partner, underwrites Virgin’s Voyage Protection plan, while Aon Affinity administers policy service and handles claims.

Like most major cruise lines, the Voyage Protection plan carries dangerously low limits for Medical Insurance and Medical Evacuation. It also lacks many of the important features of quality travel insurance policies found on the wider market, such as a Pre-Existing Medical Condition Waiver and a comprehensive list of reasons for Trip Cancellation and Trip Interruption.

The one redeeming element of Virgin Voyages’ travel insurance is that you can easily purchase it at checkout when booking your cruise online. Before you buy, check out this review to find out if the Voyage Protection plan is right for you.

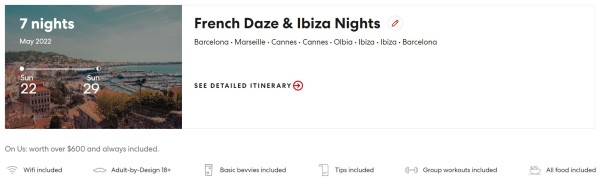

Our Cruise: French Daze & Ibiza Nights

For our review, we selected the French Daze & Ibiza Nights cruise. Our sample couple, ages 55 and 60, will be staying in The Insider suite, sailing from 5/22/22-5/29/22. The cruise begins and ends in Barcelona, with stops in Marseille, Cannes, Olbia, and Ibiza along the way. The total cost of the cruise comes to $2,600 after taxes and fees.

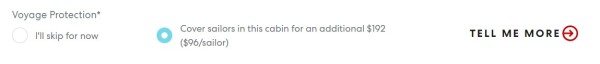

Conveniently, Virgin Voyages offers the option to purchase travel insurance at checkout.

To Virgin Voyages’ credit, their website is incredibly user friendly and easy to navigate. And obviously, it’s a simple click of “Yes” or “No” to purchase their travel insurance plan. But before you add it into your shopping cart, you need to know what your $192 is really buying - and what it’s not.

Virgin’s insurance provides travelers with $10k of medical coverage and $25k of medical evacuation coverage. Let’s see how this compares to other travel insurance in the wider travel insurance marketplace.

Comparison Quotes

When we review cruise line travel insurance plans, we always compare them to other options available on the wider travel insurance marketplace. This way, you can see what the cruise line offers, and determine whether it fits your needs or is a good value for your money.

We recommend all travelers leaving the US have ample emergency insurance in case of an overseas catastrophe. This saves you the headache and heartache of paying for medical treatment out of pocket, and a 6-figure transportation fee to return home in a worst-case scenario.

Therefore, TravelDefenders advocates carrying a minimum of $100k Medical Insurance, $250k Emergency Medical Evacuation, and a Waiver of Pre-Existing Medical Conditions whenever possible. This is the primary benchmark we use to determine if a cruise line’s travel insurance is suitable for travelers.

Using the details of the trip, we ran a sample quote to show you how Virgin Voyages’ travel insurance plan compares with two policies available at TravelDefenders.

First, we’ll compare it to Trawick First Class for $161.19, because this is the least expensive comprehensive trip insurance plan that includes our recommended minimums for Medical Insurance, Medical Evacuation and Pre-Existing Condition Waiver.

Then, we’ll compare it to the least expensive plan that meets our minimum recommendations, includes a Pre-Existing Condition Waiver, and also offers Cancel For Any Reason benefits, which happens to be the John Hancock Silver (CFAR 75%) for $262.50.

How Does Virgin Voyages Compare to the Competition?

|

Benefit |

Virgin Voyages Voyage Protection |

Trawick First Class |

John Hancock Silver (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

100% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$10,000 |

$150,000 |

$100,000 |

|

Medical Evacuation |

$25,000 |

$1,000,000 |

$500,000 |

|

Baggage Loss/Damage |

$1,000 |

$500/article, up to $2,000 |

$250/article, up to $1,000 |

|

Baggage Delay |

$500 |

$400 |

$500 |

|

Travel Delay (Incl quarantine) |

$500 ($150/day) |

$1,000 |

$750 ($150/day) |

|

Missed Connection |

No |

$1,000 |

$750 |

|

Cover Pre-existing Medical Conditions |

No |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

|

Cancel For Any Reason

|

No |

No |

Yes, if purchased within 14 days of deposit |

|

Accidental Death & Dismemberment |

No |

$25,000 (common carrier) |

$100,000 (24 hour) |

|

Cost of Policy |

$192 |

$161.19 |

$262.50 (10% of trip cost)

|

As you can see, the Voyage Protection plan offers extremely limited coverage for the $192 cost. Like many cruise line travel insurance plans, the Medical Insurance and Medical Evacuation coverage have disappointingly low limits. Furthermore, the policy does not cover Pre-Existing Conditions nor provide a Cancel For Any Reason option.

In comparison, Trawick First Class costs $30.81 less than the Voyage Protection plan on our sample quote. While this is not a significant savings, Trawick First Class provides adequate coverage for travel outside of the US, with $150k in Medical Insurance and $1m in Medical Evacuation coverage. It also covers Pre-Existing Conditions if purchased within 14 days of your initial payment or deposit towards the trip.

Our sample couple could have Cancel For Any Reason protection by purchasing the John Hancock Silver (CFAR 75%) for $70.50 more than the Voyage Protection plan. In addition to the standard cancellation coverage, our two travelers would have the option to cancel their trip for any reason and still receive a significant portion of their trip cost back. They’d also be properly protected with $100k of Medical Insurance and $500k in Medical Evacuation coverage.

We’ll discuss the importance of these coverages further below.

Trip Cancellation Reimburses You If You Can’t Travel

Travelers value Trip Cancellation benefits because the coverage allows you to get a full reimbursement of your pre-paid, non-refundable trip costs in the event you must cancel your trip for a covered reason. Of course, the more covered reasons a policy has for cancellation, the better.

Disappointingly, Virgin’s cruise insurance covers a mere 6 cancellation reasons:

- Your, a Family Member’s, a Traveling Companion’s, or a Traveling Companion’s Family Member’s death, that occurs before departure on Your Trip; or

- Your, a Family Member’s, a Traveling Companion’s or a Traveling Companion’s Family Member’s covered Sickness or Injury, that: a) occurs before departure on Your Trip; b) requires Medical Treatment at the time of cancellation; and c) as certified by a Physician, results in medical restrictions so disabling as to cause Your Trip to be cancelled;

- You or Your Traveling Companion being hijacked, quarantined, required to serve on a jury (notice of jury duty must be received after Your Effective Date), served with a court order to appear as a witness in a legal action in which You or Your Traveling Companion is not a party (except law enforcement officers);

- Your or Your Traveling Companion’s primary place of residence is made Uninhabitable and remains Uninhabitable during Your scheduled Trip, by fire, flood, or other Natural Disaster, vandalism;

- You or Your Traveling Companion being directly involved in a traffic accident, substantiated by a police report, while en route to Your scheduled point of departure;

- You or Your Traveling Companion who are military, police or fire personnel being called into emergency service to provide aid or relief for a Natural Disaster.

While covered cancellation can vary by policy, most policies cover all the above reasons and more, including but not limited to:

- A documented theft of passports or visas

- Permanent transfer of employment of 250 miles or more

- Involuntary termination or layoff

- An unannounced strike causing a complete cessation of services

- Inclement weather causing a complete cessation of services

- Revocation of previously granted military leave due to war

- Bankruptcy or default of airline, cruise line, tour operator

By comparison, both Trawick First Class and John Hancock Silver (CFAR 75%) offer 14 covered cancellation scenarios. The John Hancock Silver (CFAR 75%) also includes Cancel For Any Reason, which allows you to cancel for any reason not otherwise covered by the policy and still receive a 75% reimbursement of your trip cost.

Another important factor to consider is that the Voyage Protection plan only covers travel arrangements booked through Virgin Voyages. Any travel arrangements booked elsewhere, such as independently booked airfare and accommodations for travel time ahead of or after the cruise, would not be covered. This is typical of cruise line travel insurance plans but leaves you at risk of losing those costs if you cancel your trip.

Alternatively, third-party travel insurance plans, like Trawick First Class and John Hancock Silver (CFAR 75%), insure all of your pre-paid and non-refundable trip costs, regardless of who your travel arrangements were booked through.

Cancel For Any Reason

Cancel For Any Reason coverage is exactly what it sounds like – it allows you to cancel for any reason that’s not covered under the policy and still receive a reimbursement of your trip cost.

Many major cruise lines offer Cancel For Any Reason, which assigns a future cruise credit to the travelers if they cancel their cruise for any reason not listed on the policy. Surprisingly, Virgin Voyages doesn’t offer anything of the sort. While a future cruise credit is far from preferable, it’s better than nothing.

On the other hand, some third-party travel insurance plans, like John Hancock Silver (CFAR 75%) have Cancel For Any Reason benefits built into the policy. Instead of offering future credit, the policy gives you a cash reimbursement for a portion of the trip cost.

However, Cancel For Any Reason has a few rules. The coverage reimburses 50% -75% (depending on policy) of your pre-paid and non-refundable trip costs, provided you:

- Purchase the policy within 10-21 days (depending on the policy) of your initial payment or deposit towards the trip. For the John Hancock Silver (CFAR 75%), this timeframe, called the Time Sensitive Period, is 14 days.

- Insure 100% of your pre-paid and non-refundable trip costs, and add any subsequent payments to the policy’s trip cost within the Time Sensitive Period

- Cancel your trip no later than 48 hours prior to departure

Trip Interruption Refunds the Unused Portion of Trip

Similar to Trip Cancellation, Trip Interruption reimburses you for the missed portion of your trip if you have a covered disruption. Covered reasons for Trip Interruption mimic those of Trip Cancellation. For example, if you unexpectedly fell ill during your cruise and had to seek treatment off the ship for two days, that’s a covered Trip Interruption (along with a Medical Insurance claim).

In some cases, your Trip Interruption may allow you to return to the trip after missing a portion of it. Other times, you might have to go home early to tend to a family emergency. In the same fashion, a Trip Interruption could delay your arrival to the cruise.

In any event, travel insurance reimburses you up to your trip cost for the unused, pre-paid, non-refundable expenses for your travel arrangements, plus the additional transportation cost paid to either:

- Join your trip if you must depart after your scheduled departure date or travel via alternate route of travel; or

- Rejoin your trip from the point where your trip was interrupted or return home early

While Virgin’s barebones policy offers only 100% trip cost refund for a covered interruption, both Trawick First Class and John Hancock Silver (CFAR 75%) cover up to a 150% refund. The extra 50% helps cover the added cost of transportation.

Trip Interruption coverage that exceeds 100% is a hallmark of a robust and comprehensive travel insurance policy.

Medical Insurance When Traveling Overseas

Sometimes travelers are more focused on Trip Cancellation and overlook the risks of traveling overseas without proper Medical Insurance.

American travelers often have the false impression that countries with socialized medicine will treat them for free, but this is not the case. In fact, countries with universal health care programs only offer those services to their residents, who pay taxes for this privilege, whereas travelers must pay full price for health care. Inpatient care at a hospital can run $3,000 to $4,000 per night, plus treatments and surgeries.

Also, Medicare does not pay for your treatment outside the US. In addition, many private healthcare plans only reimburse for emergencies. For example, although some Medicare supplements cover up to $50k of emergency treatment abroad, it’s a lifetime limit and you must pay a 20% co-pay out of pocket. These policies falsely lead you to believe you’re safely covered, but they leave your retirement savings exposed to the risk of a sudden, catastrophic financial loss.

Furthermore, the US State Department does not provide any medical support to Americans traveling overseas, which is why carrying adequate Medical Insurance is critical when leaving the country.

Thus TravelDefenders recommends each traveler carry at least $100k in Medical Insurance when leaving the US. This is enough coverage to assure you’re properly treated without paying off medical bills for years to come.

Getting back to Virgin Voyages’ travel insurance, the Voyage Protection plan includes only $10k of Medical Insurance. That’s simply not going to help you in an emergency.

On the other hand, Trawick First Class includes $150k Medical Insurance and John Hancock Silver (CFAR 75%) covers $100k. These levels of coverage are much better suited for seniors cruising outside of the US.

Emergency Medical Evacuation Brings You Home

Have you ever seen a helicopter land on a cruise ship to pick up a sick passenger, or heard of someone being flown home in a private medical jet? These things happen more frequently than you think.

Specifically, Medical Evacuation coverage pays for transportation from the place of injury or illness to a local hospital. Once you’re stable and the physician treating you determines it’s necessary, Medical Evacuation returns you home. If your condition is critical and you require ongoing care by a medical team to return home, an air ambulance outfitted as a flying ICU might be most appropriate.

Private air transportation such as this can cost $15k to $25k per flight hour and coming back to the US from overseas can get very expensive, very quickly.

In addition, many travelers assume their private health insurance pays for Medical Evacuation so they can get home. In fact, private health insurance plans, including Medicare supplements, do not include Medical Evacuation benefits beyond a limited amount for a ground ambulance to the hospital. So, that medical flight cost comes out of your pocket and could cost as much as a house.

For these reasons TravelDefenders recommends all travelers leaving the US carry a minimum of $250k Emergency Medical Evacuation coverage. Travelers venturing even further from home, to destinations such as Africa, Asia, or beyond, should carry a minimum of $500k.

Virgin’s Voyage Protection plan only provides a minimal $25k Medical Evacuation benefit. Meanwhile, Trawick First Class has a benefit of $1m per person for Medical Evacuation and the John Hancock Silver (CFAR 75%) covers $500k per person.

Pre-Existing Medical Conditions

Pre-Existing Conditions are an understandable concern for many senior travelers.

In the world of travel insurance, a Pre-Existing Condition does not mean anything that’s ever happened to you in your entire medical history. Instead, travel insurance companies only concern themselves with your more recent medical history.

Most policies are only concerned about the 60-180 days prior to the day you purchased your policy. This means any conditions older than 60-180 days will be covered if none of the following has occurred within that timeframe:

- New conditions or change or worsening of previous conditions

- Treatment, testing, or examinations that have occurred or been recommended

- New or changes in medication, including dosage changes

If any of the above did occur during to 60-180-day window prior to purchasing travel insurance, it would be excluded from coverage.

Luckily, if you purchase your policy early in the booking process, within 14-21 days of making your initial payment or deposit towards your trip, many travel insurance policies include coverage for Pre-Existing Conditions with a Waiver. Once those 14-21 days pass, however, Pre-Existing Conditions aren’t covered. Instead, they’re subject to the Look Back period, the time between when you bought the policy and the 60-180 days prior.

To make life easier and give you peace of mind TravelDefenders recommends travelers buy travel insurance that includes a Pre-Existing Condition Waiver whenever possible. It’s simple to get, just by purchasing your travel insurance policy shortly after making a deposit.

The Voyage Protection plan does not cover Pre-Existing Conditions at all. They do not offer a waiver, so regardless of when you buy their insurance, they won’t cover it. One good thing in Virgin Voyages’ favor is that their policy only looks back 60 days into your medical history, rather than 90 or 180 days.

Alternatively, both policies we compared from TravelDefenders to Virgin’s Voyage Protection plan offer a Waiver of Pre-Existing Conditions, if the policies are purchased within 14 days of your initial payment or deposit.

Conclusion

Virgin Voyages offers contemporary cruising experiences, but minimal travel insurance. Their policy is deficient in critical areas such as Trip Cancellation, Medical Insurance, Medical Evacuation and covering Pre-existing Conditions. It also lacks a Cancel For Any Reason option. Overall we rate it a 7 out of 10.

Trawick First Class is one of many TravelDefenders policies that provides outstanding value for the money, with a savings of $30.81 over the Voyage Protection plan, for exponentially better coverage.

While a higher tiered plan like John Hancock Silver (CFAR 75%) costs $70.50 more than the Voyage Protection plan, it offers many of the features and flexibility anyone would want in a travel insurance policy and is a better value for your money.

In addition, you cannot insure your other travel arrangements with Virgin Voyages’ policy, but you can insure them under a policy purchased in the wider travel insurance marketplace. You’ll find more value for your money working with TravelDefenders.

Did you know you won’t find lower prices on the same policy anywhere else, not even with the insurance company directly? At TravelDefenders, we take the nation’s top travel insurance carriers and bring them in our marketplace where you can shop and compare different plans.

Visit TravelDefenders first to see your options before committing to the first travel insurance policy you’re offered. Stop by and have a chat, send an email or give us a call at +1(786) 321 3723.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customerLinda Gayles Wolfe

Jason was very helpful

Jason was very helpful

Pat

Thorough

Destiny was very helpful answering all my questions and helpful information I hadn’t thought of