MSC Cruises Travel Insurance – 2025 Review

MSC Cruises Travel Insurance – Review

7

Strengths

- Strong Insurance Partner

- Solid list of covered cancellations

Weaknesses

- Weak Medical Insurance

- Weak Medical Evacuation

- Only one Cancel For Work Reason

Sharing is caring!

MSC Cruises Travel Insurance – Overview

MSC Cruises is a first-class cruise line with an Italian flair. They have a strong presence in the Mediterranean cruise market and growing in South America, Asia and the Caribbean. In addition, they are building a second Miami port terminal and private Bahamian island resort.

Cruise travelers can find the MSC Trip insurance rate when booking on MSC’s website.

Generali US Branch underwrites the MSC Cruises Travel Insurance, which is a reliable insurance provider. They are an “A” rated (Excellent) insurer by AM Best, an independent organization that rates insurance companies based on their financial strength.

In this review, we examine the benefits in MSC Cruises Travel Insurance, the cost of the plan, and the overall coverage. Finally, we compare MSC Cruises Travel Insurance with other travel insurance plans possessing better coverage and lower prices available through TravelDefenders.

Our MSC Cruise – 7- Night Mediterranean Cruise

For our review our sample couple, both aged 60, selected a 7-day Mediterranean cruise from 10/30/2022 – 11/6/2022 on MSC Seaview in a balcony cabin for $2,494.70.

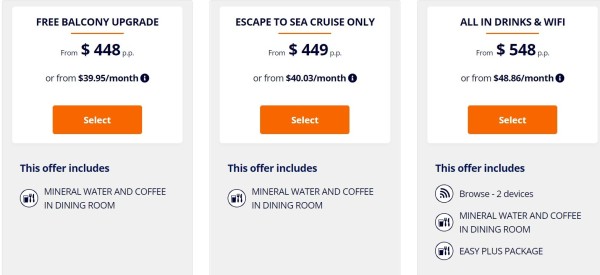

There are several upsells available as you proceed through the checkout process that can add to the total cost:

We selected the Free Balcony Upgrade for $448 per person for a total of $896.

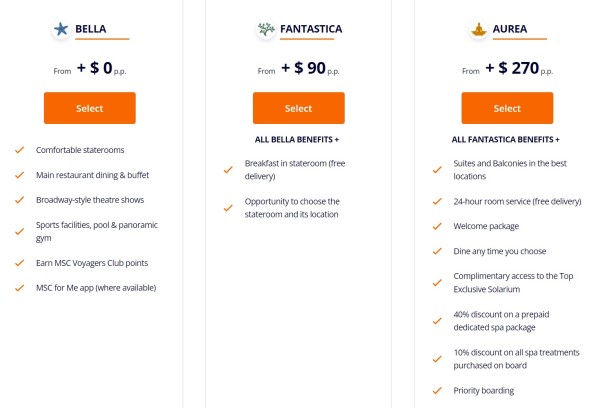

Next, you have a choice of 3 packages with dining options as well as discounts for other available packages:

We chose the Bella which comes with the chosen stateroom, so no additional charges were incurred.

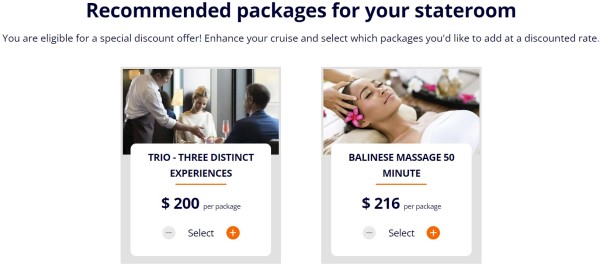

Finally, there are several experience packages you can add such as massages:

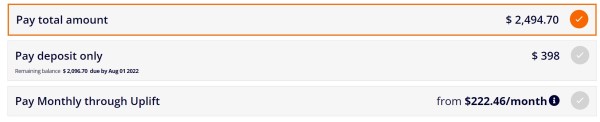

Our final total after going through all the upsells offered came to $2,494.70. If we want to add insurance to our cruise, we can add it prior to checkout for $320. This insurance provides $25,000 of medical coverage per person and $50,000 of medical evacuation coverage per person.

We’ve opted to exclude the insurance and see if we can find better coverage elsewhere.

Going to the checkout page, MSC has several payment options available including paying just for the deposit at that time or even paying the full amount monthly through Uplift. For the purposes of our review, we’ll be looking at the total amount of $2,494.70.

MSC Cruises Cancellation Policy

If you opt out of MSC’s travel insurance policy, the cruise line charges cancellation penalties as follows:

Note: MSC Cruises has a different cancellation charge chart for World Cruises which we do not cover in this review.

Comparison Quotes

Let’s compare the MSC Cruises Travel Insurance with travel insurance policies available at TravelDefenders. When traveling outside the United States, we recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver. We used these criteria to choose the selected quotes.

Using the $2,494.70 trip cost for our cruise, the least expensive option from TravelDefenders that contained the minimum recommendations was the AIG Travel Guard Plus. This plan provides $100k Medical Insurance, $1 million of Emergency Evacuation coverage, and a Pre-Existing Condition Waiver as long as the policy is purchased within 21 days of the initial trip payment or deposit date. Total cost for both travelers is $161.52.

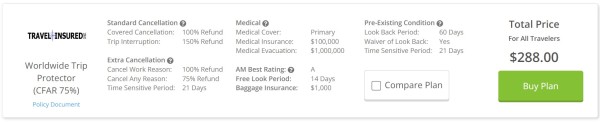

While MSC Cruises Travel Insurance does NOT offer a Cancel For Any Reason (CFAR) option, we can find these policies in our quote from TravelDefenders. The least expensive CFAR policy is the Travel Insured Worldwide Trip Protector (CFAR 75%). This plan provides $100,000 of medical coverage, $1 million of medical evacuation coverage and a Pre-Existing Condition Waiver as long as the policy is purchased within 21 days of the initial trip payment or deposit date. The plan also provides a 100% refund if you must cancel for a work-related reason and a 75% refund if you cancel for any reason not listed in the policy. Total cost for both travelers is $288.00.

Next, we broke down the benefits of each policy in a side-by-side comparison:

|

Benefit |

MSC Cruises Travel Insurance |

AIG Travel Guard Plus |

Travel Insured Worldwide Trip Protector (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

100% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$25,000 |

$100,000 |

$100,000 |

|

Medical Evacuation |

$50,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$3,000 |

$500/article up to $2,500 per person |

$1,000 per person |

|

Baggage Delay |

$100 |

$400 |

$300 |

|

Travel Delay (Incl quarantine) |

$600 |

$1000 per person |

$1000 ($200/day) |

|

Missed Connection |

No |

$1,000 per person |

$500 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 24 hours of final trip payment |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 21 days of deposit |

|

Cancel For Work Reason |

No |

100% of trip cost |

100% of trip cost |

|

Interrupt For Any Reason |

No |

No |

100% of trip cost |

|

Cancel For Any Reason

|

No |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$25,000 |

$25,000 |

$10,000 |

|

Cost of Policy |

$320 (12.8% of trip cost) |

$161.52 (6.5% of trip cost) |

$288.00 (11.5% or trip cost) |

Cost Comparison

Overall, the MSC Cruises Travel Insurance plan has very minimal coverage. Their plan only provides $25,000 of medical coverage and $50,000 of medical evacuation coverage, which is much lower than our recommended minimum when traveling overseas. The policy does provide a waiver to cover Pre-existing Medical Conditions if the policy is purchased within 24 hours of the final trip payment which is a much longer time period than most plans provide. However, there is no option available to cancel for any reason.

By shopping for cruise insurance through TravelDefenders, our two travelers can save anywhere from $32 - $158.48 which can be applied to airfare, additional tours, or shopping.

In the following sections, we discuss know what to look for when shopping for travel insurance for your MSC cruise.

Trip Cancellation

When a traveler purchases MSC Cruises Travel Insurance, they are subject to the 20 covered trip cancellation reasons listed in the policy. Here are a few:

- The sickness, injury or death of you, your family member, your traveling companion or your service animal

- Common carrier delays and/or cancellations resulting from adverse weather, mechanical breakdown of the aircraft, ship, boat or motor coach that you were scheduled to travel on, or organized labor strikes that affect public transportation

- Being directly involved in a documented traffic accident while en route to departure on your trip

- A documented theft of your passports or visas;

- Being required to serve on a jury, or required by a court order to appear as a witness in a legal action

- Your home made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster

Interestingly, this is the first cruise insurance we’ve seen that includes service animals as a reason for cancellation.

Trip Interruption

A trip interruption occurs when your trip is delayed past your scheduled departure date or if you are unable to continue the trip due to one of the unforeseeable covered events listed.

Some of the most common reasons for a trip interruption are:

- The unforeseen illness or injury to a traveler, traveling companion or family member

- The death of the traveler, traveling companion or family member

- Natural disaster rendering the travelers home uninhabitable

MSC Cruises Travel Insurance covers trip interruption and refunds unused, non-refundable prepaid land or water arrangements.

In addition, the MSC Cruises Trip Insurance policy will offer some reimbursement of expenses to catch up to a missed tour or cruise or cost to return home early. Either way, the MSC Cruises Travel Insurance only pays a maximum of 100% of the trip cost. Both the AIG Travel Guard Plus and the Worldwide Trip Protector (CFAR 75%) will pay up to 150% of the trip cost.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

MSC Cruises Travel Insurance does not offer a “Cancel For Any Reason” benefit. If you need to cancel for a reason that is either not on the covered cancellation, or happens to be on the exclusions list, a partial or no refund will be issued depending on the date of cancellation.

Alternatively, travel insurance policies like Travel Insured Worldwide Trip Protector with Cancel For Any Reason included pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of MSC Cruises. This could include flights, hotels, rental cars, excursions and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Cancel For Work Reasons

MSC Cruises Travel Insurance offers a cancel for work reason benefit in the form of involuntary termination:

Your involuntary termination of employment or layoff (or the involuntary termination or layoff of your parent or guardian if you are a minor traveling alone), after continuous employment with the same employer for 1 year or more, provided the termination or layoff occurs 14 days or more after your coverage has taken effect.

This benefit is not available to temporary employees, independent contractors, or self-employed persons.

This condition is listed under the “Covered Cancellation” reasons in the policy. However, if your employer granted time off, then rescinded its offer and required you to work or transferred you over 100 miles from home, the MSC Cruises Travel Insurance would not permit these reasons as a covered cancellation. However, many policies including the AIG Travel Guard Plus and the Travel Insured Worldwide Trip Protector (CFAR 75%) offered by TravelDefenders do. They provide a 100% refund for these Cancel For Work Reasons.

Emergency Medical Insurance

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

TravelDefenders urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

MSC Cruises Travel Insurance provides a $25,000 benefit for Medical Insurance, which is only a quarter of our recommended amount of coverage. AIG Travel Guard Plus and the Travel Insured Worldwide Trip Protector (CFAR 75%) both include $100,000 per person of Medical Insurance, so you can receive proper treatment without ending up in debt.

Pre-existing Medical Conditions

Many travel insurance policies, particularly those sold by cruise lines, exclude pre-existing medical conditions from a covered cancellation. If you cancel due to a medical condition that’s considered pre-existing, the trip insurance will not refund any of the trip cost.

According to the MSC Cruises Travel Insurance policy:

A pre-existing medical condition means a Sickness or Injury during the 60-day period immediately prior to your effective date for which you or your Traveling Companion:

- received, or received a recommendation for, a diagnostic test, examination, or medical treatment; or

- had a change in or received a new prescription for medication.

Older, stable conditions are covered.

We are happy to see a cruise line travel insurance offer a Waiver of Pre-existing Conditions. However, MSC Cruises Trip Insurance requires 3 conditions met to cover a pre-existing condition:

- coverage is purchased prior to or within 24 hours of your final Trip Payment; and

- you are medically able to travel at the time the coverage is purchased; and

- you insure 100% of your prepaid Trip costs booked through the supplier from MSC Cruises that are subject to cancellation penalties or restrictions.

This is another point in favor of MSC’s insurance. Cruise insurance policies rarely offer this Medical Waiver. Both the AIG Travel Guard Plus and the Travel Insured Worldwide Trip Protector (CFAR 75%) provide coverage for pre-existing medical conditions provided the policy is purchased within 21 days of the initial trip payment or deposit. TravelDefenders advocates travelers include a Medical Waiver for added protection while traveling, particularly for seniors.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TravelDefenders advises travelers to get at least $250,000 Medical Evacuation, $500,000 for Asia or Africa or beyond, to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event.

MSC Cruises Travel Insurance includes Medical Evacuation up to $50,000 per person, which is much lower than our recommended $250,000. Both the AIG Travel Guard Plus and the Travel Insured Worldwide Trip Protector (CFAR 75%) provide $1,000,000 per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Price and Value

MSC Cruises Travel Insurance carries minimal coverage and is more expensive than other available options. The medical insurance coverage is only $25,000, and only $50,000 for medical evacuation, which may not be adequate for a serious illness or injury. There is no Cancel For Any Reason option and Cancel For Work Reason is limited to a layoff only. While not as expensive as other cruise insurance we’ve seen, overall, the MSC Cruises Travel Insurance offers limited value for the price.

In contrast, by comparison shopping, we found the AIG Travel Guard Plus policy comes in at $161.52 ($158.48 LESS than MSC!) It includes superior medical and evacuation benefits, 100% refund for trip costs for covered cancellation, 150% refund for covered trip interruption, and a 100% refund for a robust list of cancellation reasons.

While the MSC Cruises Travel Insurance doesn’t have a Cancel For Any Reason option, by shopping at TravelDefenders we found the Travel Insured Worldwide Trip Protector (CFAR 75%) for $288.00 ($32 LESS than MSC!) It includes $100,000 medical insurance and $1,000,000 medical evacuation. Plus, it includes a Cancel For Any Reason provision that refunds 75% of trip costs back in cash. It has superior coverage over MSC’s policy for a lower cost.

Conclusion

MSC Cruises Travel Insurance provides travelers with a minimal insurance policy that could leave travelers unpleasantly surprised during an emergency. Medical coverage and medical evacuation limits are low, and there are only one reason available for Cancel For Work. Though they have a strong partner in Generali, the insurance itself is rather weak. Overall, we rate it a 7 out of 10.

Travelers planning a MSC cruise will find the best value for their money and peace of mind when they shop for travel insurance at TravelDefenders Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TravelDefenders recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning an MSC cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TravelDefenders.com or alternatively call us at +1(786) 321 3723. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

ANNE MACAULEY

The best travel insurance that I could…

The best travel insurance that I could find! Very simple to purchase what you are needing!!!

Bob

Kendall P. Very helpful.

Kendall P. was a person I talked to about getting a policy. He was very knowledgeable about the plans and about what might be best for me. I had already looked at policies on line so thought I knew what I needed and wanted. Kendall without knowing led me to the same policy. I bought it. Best rep of any kind I have talked to.