Grand Circle Travel Insurance - 2024 Review

Grand Circle Travel Insurance

6

Strengths

- Strong insurance partner

- Good Medical Evacuation limit

- Pre-Existing Medical Condition Waiver

Weaknesses

- Low Medical Insurance limit

- Expensive

- One travel insurance option

Sharing is caring!

Background

Grand Circle Cruise Line and Grand Circle Tours have been in business for over 60 years and supply small ship river and ocean cruises as well as land tours.

Grand Circle Cruise Line and Grand Circle Tours offer one travel insurance program to protect your trip investment. You will receive a quote choice during checkout on Grand Circle's website. They automatically add the insurance program unless you opt-out.

The plan offers adequate Medical Evacuation but inadequate Medical Insurance for traveling outside the U.S. Although it touts a Cancel For Any Reason feature, it only compensates you with a travel voucher.

Unfortunately, it does not offer any optional features to customize the plan.

BCS/Jefferson Insurance underwrites the plan administered by Allianz.

Grand Circle travel insurance does not extend coverage for costs associated with other travel services not directly set up by Grand Circle Travel. Thus, you need additional travel insurance to cover any extra prepaid and non-refundable arrangements.

When shopping for international travel insurance, we recommend buying a policy with at least $100,000 Medical Insurance, $250,000 in Medical Evacuation coverage, and a Pre-existing Medical Condition Waiver.

TravelDefenders provides an easy online insurance quoting and purchasing experience. All of TravelDefenders's policies can incorporate the prepaid and non-refundable amounts for your trip costs, such as airfare, cruise fare, accommodations, and excursions.

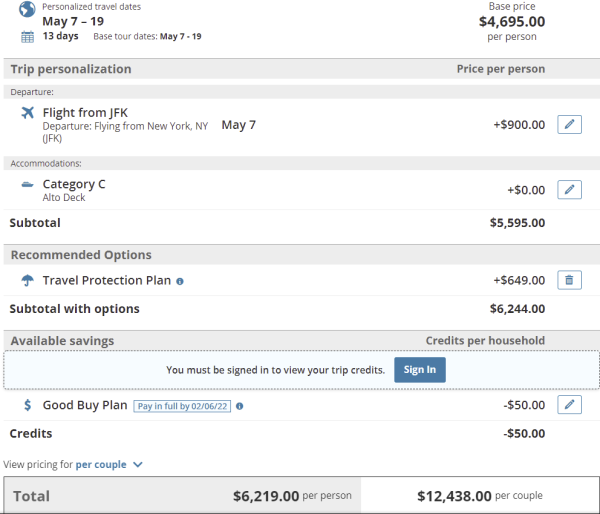

Sample Cruise Itinerary: 13-Day Cruising Paris to Normandy

Our example trip costs $11,190 for two travelers, aged 55 and 60.

Grand Circle insurance does not factor age into the premium. They charge a flat rate based on the trip cost.

For this trip, Grand Circle travel insurance costs $1,298 for both travelers. ($649 each)

Comparison Quotes

When shopping for travel insurance, TravelDefenders always recommends you buy at least:

- $100,000 in Medical Insurance per person

- $250,000 in Medical Evacuation per person

- Waiver for Pre-Existing Medical Conditions

You do not want to be caught overseas, figuring out how to pay for unexpected medical care. We urge travelers to buy this level of coverage.

For this trip, Trawick First Class is the least expensive plan that meets the minimum coverage. For two travelers, it costs $589.57.

If you want the highest protection level, you can opt for a Cancel For Any Reason (CFAR) plan. In this case, the least expensive Cancel For Any Reason plan is Trawick First Class (CFAR 75%) at $1,002.27 for both travelers.

Both options from TravelDefenders are significantly less expensive than Grand Circle travel insurance.

|

Benefit |

Grand Circle Cruises Travel Insurance |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

100% up to 100,000 |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$150,000 |

$150,000 |

|

Medical Evacuation |

$500,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$2,000 |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$600 |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$300 per day up to $1,500 |

$1000 per person |

$1000 per person |

|

Missed Connection |

$300 per day up to $1,500 |

$1,000 per person |

$1,000 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 10 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

N/A |

No |

100% of trip cost |

|

Interrupt For Any Reason |

N/A |

No |

100% of trip cost |

|

Cancel For Any Reason

|

Travel Voucher for the penalty amount |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$25,000 |

$25,000 |

$25,000 |

|

Cost of Policy |

$1,298.00 (11.6% of trip cost) |

$589.57 (5.27% of trip cost) |

$1002.27 (8.96% or trip cost) |

Cost Comparison

Above, we see that Trawick First Class offers higher medical benefits levels than Grand Circle travel insurance for half the cost. Trawick First Class also includes Pre-existing Medical Conditions when you buy the policy within 2 weeks of your first deposit.

Grand Circle Cruise Medical Insurance is half the amount we recommend for anyone traveling abroad. It incorporates Cancel For Any Reason, which is acceptable, but Grand Circle only compensates you with future credit, not cash.

Trip Cancellation

Grand Circle Cruises offers two types of Trip Cancellation benefits: covered reasons and cancel for any reason.

If you cancel your Grand Circle cruise for any of these covered reasons, the policy refunds you 100% of your money:

- Sickness, injury, or death of traveler, traveling companion, or family member

- Quarantine, jury duty, court order to appear as witness for traveler or traveling companion

- Traveler or traveling companion’s place of employment damaged due to natural disaster, requiring traveler or traveling companion to remain at work

- Documented theft or loss of passport or visa

- Job transfer

- Documented traffic accident-causing missed trip departure

- Organized labor strike, bad weather, or mechanical breakdown of aircraft for 24 hours or more

- Shutdown of airport or air traffic control system for 6 hours or more preventing trip departure

- Emergency military duty resulting from natural disaster for traveler or travel companion

- Previously granted military leave revoked for traveler or traveling companion

- Job termination or layoff with employer

When purchasing the Grand Circle policy within 14 days of the initial deposit, it automatically includes coverage for pre-existing illnesses and injuries. If the policy was purchased within 10 days from the initial deposit date and you cancel for a pre-existing reason you will receive a cash refund. However, if you purchase the insurance more than 10 days after paying the deposit, Grand Circle gives you a future credit for any cancellations due to Pre-existing Medical conditions.

Likewise, if you cancel for any reason not named in the policy, Grand Circle issues future credit for the full value of the trip. Grand Circle honors this benefit until the day of departure.

Worth noting, if you bought airfare or other arrangements from another supplier, Grand Circle cruise insurance would not cover them. You would need to purchase a separate policy to cover any additional travel plans booked outside of Grand Circle.

Grand Circle Medical Benefits Cover Hospitalization and Evacuation

Imagine on Day 3 of the trip you head to the Welcome dinner in Paris. As you stroll down the street admiring the lights, you trip on a stone curb. You fall and hit your shoulder and head. After an ER visit, the doctor advises you to return home as soon as possible to see a neurologist and orthopedic surgeon.

Occasionally, disastrous trips happen. No one wants to think about it, but this is why travel insurance exists. If this happened to you, your travel policy's medical benefits would cover your ambulance rides, hospitalization, tests, and treatment. Plus, it would reimburse you for the unused part of your trip.

Medical Insurance is a critical benefit when outside the US. Even in countries with lower-cost health care, you pay out of pocket. In a life-threatening situation, you could face significant bills.

As a result, TravelDefenders urges you to take adequate medical insurance on travels abroad. We recommend a minimum of $100,000 Medical Insurance and $250,000 Medical Evacuation. Whenever possible, TravelDefenders advises you also get a policy with a Pre-existing Condition Waiver that closes coverage gaps.

Health insurance and Medicare do not pay outside the US. Some Medigap policies include $50,000 for international emergencies while others do not. Only travel insurance includes Medical Evacuation to return you home.

Grand Circle travel insurance provides only $50,000 Medical Insurance. However, it may not be enough protection, should a severe illness or injury occur while traveling. On the other hand, Trawick First Class includes $150,000 for medical bills and costs half the price.

Similarly, Grand Circle travel insurance offers a reliable $500,000 Medical Evacuation benefit, which exceeds our recommended coverage. That is plenty to cover medical transportation home, so you can return home for further treatment.

Trip Interruption

After a long flight to France, suppose you check your phone and hear a message that a family member suddenly passed away. You just started your trip 48 hours ago but must return home immediately.

Trip Interruption insurance reimburses you for the unused prepaid portion of your trip and the extra cost to return home if your situation is listed in the policy:

- Traveler, traveling companion, or a family member suffers an illness, injury, or death

- Quarantine, court appearance, hijacking, terrorist event

- Your residence or destination is uninhabitable

- Involved in a traffic accident

- Travel delay of 24 hours or more due to natural disaster, severe weather, strike

- Military reassigns or revokes leave of a traveler

- Mandatory evacuation at destination

Like Trip Cancellation, Interruption is an essential benefit in a comprehensive travel insurance policy. Grand Circle reimburses up to 100% of your trip costs. However, if your return transportation exceeds that amount, you pay for it yourself.

Most policies at TravelDefenders pay up to a 150% Trip Interruption benefit. The extra 50% helps cover the cost to return home early. Trawick First Class and Trawick First Class (CFAR 75%) plans provide a 150% Trip Interruption benefit.

Pre-existing Medical Conditions

Grand Circle travel insurance covers Pre-existing Conditions. The policy includes a Waiver of Pre-existing Medical Conditions if the policy is purchased up to 14 days after the initial trip payment or deposit. We highly recommend purchasing a policy that will provide coverage for Pre-existing Conditions, if possible. The Waiver allows the policy to cover new or recently worsened Pre-existing Conditions. Typically, travel insurance excludes them unless they are older and under control with medication.

The policy automatically provides the Waiver to cover Pre-existing Medical Conditions when you buy the plan within 14 days of your initial deposit. However, Grand Circle added a very peculiar term: They only allow you to cancel (and receive a cash refund) if you buy the policy within 10 days of the initial trip deposit. Outside of that 10-day period they will provide a voucher in lieu of a cash refund.

If you buy the plan after that 14-day window expires, you would be subject to the policy's look back period. For Grand Circle travel insurance, the look back is 120 days. In other words, it excludes any condition for which a treatment, test, medicine change, or new prescription was added within the 120 days before buying the policy.

If the last 120 days are clear, then you are covered for Trip Interruption and Medical benefits. Unfortunately, it still does not mean you are eligible for a full cash refund for Trip Cancellation. The only time Grand Circle pays a cash refund for Trip Cancellation is when you buy the plan within 10 days of enrollment. In all other cases, they offer future credit vouchers.

Trawick First Class and Trawick First Class (CFAR 75%) include Pre-existing Condition Waivers when you buy within 14 days of initial deposit. Both pay a cash refund for a Trip Cancellation triggered by a Pre-existing Condition.

Cancel for Any Reason

As discussed earlier, Grand Circle cruise insurance offers a Cancel For Any Reason provision, but it only provides a voucher for future travel. In most cases, people prefer to receive cash money instead of future credit. You have more flexibility to spend it on things you need, particularly if you have a financial emergency.

Grand Circle Cruises has a few rules for vouchers:

- Valid for travel within 12 months of the issue date

- Cannot be used later than 15 months from the cancellation date

- Non-refundable, non-transferable, not redeemable for cash

- Must be issued in the name of the traveler

- Cannot be used toward future initial deposit or for another insurance plan

Alternatively, Trawick First Class (CFAR 75%) pays a cash benefit up to 75% of your trip cost. It costs $295.73 LESS than Grand Circle trip insurance but offers more robust features, like 3x the Medical Insurance.

With Cancel For Any Reason plans, you must:

- Buy within 10-21 days (depending on policy) from the initial deposit

- Cover all prepaid travel plans and top off the policy with travel arrangements booked later

- Be fit to travel when buying the policy

It is always helpful to research plan options to determine the best options for your particular trip.

Conclusion

Although Grand Circle Cruises offers outstanding travel experiences, you may want to consider other options before buying their travel insurance.

Unfortunately, they offer only one insurance option to meet the varied needs of their travelers. Even though Great Circle Travel works with a reputable insurance partner, it lacks adequate Medical Insurance and is expensive. Overall, we rate it a 6 out of 10.

TravelDefenders can offer you many options that provide higher limits for Medical Insurance and similar Medical Evacuation for a lower cost.

Can I Save Money Buying Directly from the Insurer?

No. Travel insurance is highly regulated, so you will find identical prices whether you buy the plan from the insurer or us. We have licensed agents to answer your questions and someone to advocate on your behalf if something is not right.

If you value finding the right coverage for your needs, TravelDefenders can educate you about your available insurance options. Review and compare over 30 policy options at your fingertips.

Please stop by and chat with us, send us an email, or give us a call at +1(786) 321 3723.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customerLinda Gayles Wolfe

Jason was very helpful

Jason was very helpful

Pat

Thorough

Destiny was very helpful answering all my questions and helpful information I hadn’t thought of